Volume #16 | IssueNo. 299/2024 | April 2024

CSR = Citizen Social Responsibility!

Weddings are all about joy, celebrations, decorations, lights, music, shopping, spending, food, clothes, jewellery, gifts, travel, accommodation, friends and family as two beautiful souls come together, taking a vow to lead a life of care, compassion and love, come what may. While every single aspect is thoughtfully planned and executed, hardly any thought goes towards the waste generated during the event. It is common sight to find the ubiquitous plastic water bottles, hardly sipped or half-used, mindlessly left all over the wedding venue. Plastic-film wrapped flower bouquets, plastic covers, glossy gift wraps, single use plastic cutlery turn the well-decorated place into a complete trash house as the revelries come to an end. Only to go to land-fills. Only to pollute the soil, water and air for now and all generations to come. Doesn’t Mother Earth need care, compassion and love too ?

The theme of Earth Day, 2024 is “Planet vs. Plastics”. Well I was not aware of this when my son’s wedding was fixed for December, 2023 but I strongly felt it was a fit and proper occasion to work towards ‘One Earth, one chance: let’s make it count’! We explored minimum usage of plastic and celebrated it as a ‘green, responsible, sustainable wedding’. Happy to share that with a strong purpose, careful planning, correct choice of vendors, specific communication to them, special appeal to guests, a low-waste wedding became a reality. What did we do and how did we do it ?

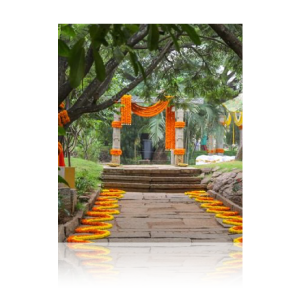

- The young couple preferred an open-air venue with the mandap open to the skies, set amidst green trees, expansive space and an earthy, rustic setting. We found that in https://www.shankaraa.com/ in a concrete jungle like Bangalore. It helped that the wedding was in a pleasant wintry-December that did not require fans or air conditioners.

- Hardly 50 wedding invitation cards were printed to personally invite elders of the family. It was a simple, post-card size invite that was designed by the couple themselves. No fancy layers of paper or decoration. Whatsapp was the way to go for all e-invites and a personal phone call in most cases. We had about 2000 guests overall even though we chose to minimise personal visits (this is not to undermine the joy of meeting people in person).

- Card had a special appeal “We are attempting a minimum waste wedding. Please help us by avoiding bouquets, gift wrapping and plastic”. About 90% of guests appreciated and used digital payments for gifts. So did we, for our close family circle.

- The wedding decorator worked on the Go-green theme

Reducing/ avoiding use of plastic

Reuse vs. One time use materials

Recycling the resources

Decor – Going local, using seasonal flowers, reducing carbon footprint

Not using Flex, plastic covers, flower packaging as much as possible - Said No to plastic pet bottles, paper glasses, straws, paper plates, plastic spoons, katoris. Caterers were instructed to serve water in glass and steel tumblers instead of distributing sealed plastic water bottles to every person. They resisted initially but gave in when we were firm. Saved not only plastic but also reduced our costs drastically considering how each guest thoughtlessly picks up a new water bottle each time he/she feels thirsty instead of carrying the old one around.

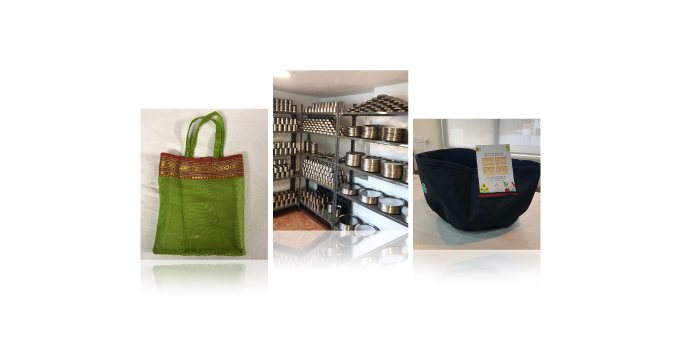

- Breakfast and lunch served on traditional banana leaves that are bio-degradable was relished and appreciated by all. Wherever needed, we used steel plates, tumblers and spoons along with reusable porcelain crockery. Where did we source 500+ steel items from ? That too at zero cost ? From https://www.adamyachetana.org/plate-bank/, an NGO being run by Dr. Tejaswini Ananthkumar which has a zero waste, steel cutlery bank that operates on a refundable deposit basis. While the caterers were initially reluctant, they agreed when we insisted and got extra cleaners as well. Surprisingly, not a single cutlery was lost and we could return 100% to the NGO.

- Two of my clients chipped in when I chose sustainable return gifts. www.trustbasket.com offered fabric grow bags and vegetable seeds which we distributed in brown paper carry bags instead of plastic covers. Similarly @themaaninistore (Maanini Vasthra Samskrithi) arranged for multi-hued thambula bags made from light-weight, handloom sarees that added a splash of colour to the green environment. Helped in replacing plastic and other typical, cheap non-degradable carry bags.

Many more initiatives made the wedding innovative, fun and a minimum-waste event. www.hasirudalainnovations.com, another client of mine were the Waste Management Partners at the venue and made sure their trained waste pickers, cleaners kept the venue trash free and scientifically segregated different types of waste for further processing. As per HDI Impact report for the wedding ceremony, Wet waste was sent to bio-gas facility that produces renewable energy for cooking and slurry for fertilizer. Dry waste was sent to aggregation centre and recycled as buttons for fashion industry, flex turned into waste collection bags and roof covers for needy, non-recyclable waste co-processed at kilns as alternatives to fossil fuels. Garden waste sent to composting facility for composting and donation to farmers. Reject waste that cannot be processed was sent to authorised, scientific landfills. Social impact as per report – 11 front-line workers empowered, 75% being women, 1 micro-entrepreneur involved and 400% increase in monetary benefits to workers !

CSR need not be Corporate Social Responsibility alone. It can also be Citizen Social Responsibility, in our own small-little ways. Give it a try. Just like the journey of Samhita, one issue at a time, carrying regulatory udpates and messages of social relevance since 2009. Today we are 1 short of the 300th issue!

For any previous issues of Samhita and the readers’ feedback, please visit sharadasc.com

ICSI UPDATE

PMLA Portal for CS in Practice

In our 288th, 290th and 292nd Issue of Samhita, we had covered updates on PMLA for practising professionals. As per the guidelines issued by the FIU-India for practising professionals in July 2023, ICSI being the governing statutory body for CS professionals, it has been tasked with certain obligations. Spreading awareness on PMLA compliance, issuing guidance on KYC and Customer Due Diligence, supervising reporting entities etc are some of them. In furtherance to the same, ICSI has developed a PMLA Portal for registration of practising CS falling within the ambit of Reporting Entity under PMLA in line with the May 2023 notifications.

In our 288th, 290th and 292nd Issue of Samhita, we had covered updates on PMLA for practising professionals. As per the guidelines issued by the FIU-India for practising professionals in July 2023, ICSI being the governing statutory body for CS professionals, it has been tasked with certain obligations. Spreading awareness on PMLA compliance, issuing guidance on KYC and Customer Due Diligence, supervising reporting entities etc are some of them. In furtherance to the same, ICSI has developed a PMLA Portal for registration of practising CS falling within the ambit of Reporting Entity under PMLA in line with the May 2023 notifications.

IBBI Update

In September 2023, the IBBI had issued a circular providing clarification on liquidators’ fees under Regulation 4(2)(b) of the IBBI (Liquidation Process) Regulations, 2016. It explained various aspects involved in calculation of liquidators’ fee where the same is not fixed by the Committee of Creditors or Stakeholders’ Consultation Committee (SCC), as the case may be. Vide circular dated April 18, 2024, IBBI has notified that Para 2.1 and 2.5 of the aforesaid circular stands withdrawn. These paras pertained to calculation of “Amount Realised” and “Period of calculation of fee” respectively.

RBI Updates

RBI vide notification dated April 23, 2024 has amended Regulation 5 of the Foreign Exchange Management (Foreign Currency Accounts by a person resident in India) Regulations, 2015. Pursuant to this amendment, funds raised by listing of equity shares of companies incorporated in India on the International Exchanges are allowed to be held in foreign currency accounts with a bank outside India, where such funds are pending utilization or repatriation to India.

These amendments are in light of the overseas listing provisions notified by the Ministry of Corporate Affairs and RBI earlier this year. Currently, the International Financial Services Centre in India is covered under permissible foreign jurisdiction for listing.

RBI vide notification dated April 23, 2024 has amended Foreign Exchange Management (Mode of Payment and Reporting of Non-Debt Instruments) Regulations, 2019. It specifies that purchase of equity shares of Indian Company listed on International Exchange can be made either by remittance to a bank account in India or by depositing in a foreign currency account of the Indian company held in accordance with FEMA (Foreign Currency Accounts by person resident in India) Regulations, 2015. Further, the sale proceeds (net of taxes) of such equity shares may be remitted outside India or may be credited to the bank account of the permissible holder maintained in accordance with the Foreign Exchange Management (Deposit) Regulations, 2016.

IT Updates

As per the provisions of the Income Tax Act, 1961, the deductors/collectors of TDS/TCS as the case may be, are required to deduct or collect TDS/TCS at a higher rate where the deductees’/collectees’ PAN is inoperative due to non-linkage of PAN with Aadhar. Certain taxpayers have been receiving notices for committing default of short deduction/collection. With a view to address this grievance, CBDT has modified rule 114AAA of the Income Tax Rules, 1962 vide circular dated April 23, 2024. As per the circular, the deductors/collectors shall not be liable for short deduction/collection for transactions entered into up to March 31, 2024 and in cases where the PAN becomes operative on or before May 31, 2024.

Owing to technical issues, the CBDT has been extending the timeline for filing of Form No. 10A/10AB by trusts, institutions and funds from time to time. The last extended date was September 30, 2023. Considering the continuing difficulties faced by the taxpayers and other stakeholders in the electronic filing the said forms, CBDT vide circular dated April 25, 2024 has extended the due date for filing the said forms to June 30, 2024.

GST Updates

If turnover exceeds INR 5 crores in the financial year 2023-2024, taxpayers are required to start e-Invoicing from April 01, 2024 onwards. For assessees who meet this criterion but e-invoicing option is not auto-enabled on the portal, it can be self-enabled by visiting https://einvoice.gst.gov.in and following the instructions in the GSTN Advisory dated April 03, 2024.

GSTN vide Advisory dated April 09, 2024 has released a new feature for GSTR-1 filing wherein the HSN-wise summary from e-Invoices will be auto populated in Table 12 of GSRTR-1. Taxpayers have been advised to reconcile the auto populated data with their records before final submission. Any discrepancies or errors can be manually corrected or added in Table 12 before final submission.

May 2024

Quote of the day

"Earth rejoices in our words, breathing and peaceful steps. Let every breath, every word and every step make the mother earth proud of us."

- Amit Ray

Disclaimer: The contents of this Newsletter are only a summary and has not dealt with any issue in detail. Any action taken or proposed to be taken must be in consultation with professionals and not merely based on the articles / news updates. S. C. Sharada & Associates disclaims all liability on action taken without professional advice.