Volume #17 | IssueNo. 312/2025 | May 2025

What You Love, You Do Best !

“Do more of what you love, less of what you tolerate and none of what you hate.”- Unknown🙏

A ‘Ross Mathematics Program’ child prodigy, a Forbes ‘30 under 30’ lawyer, a ‘NY food guide featured’ chef – these are my 3 young protagonists who embody this inspiring quote !

- First in line, the youngest of the lot. All of 15 years – Ms. Anushka Tonapi who has just graduated out of high school, scoring a whopping 99% in 10th grade alongside pursuing other interests close to her heart.

I have seen her as a little child contributing poetry to Children’s World magazine published by CBT children’s book trust, winning Commonwealth Essay Contest Gold and Silver awards and as a teenager, displaying her rich oratory skills on complex topics on a number of occasions. She is a young leader with a heart, a disability advocate creating awareness about Clubfoot which is a congenital foot disorder.

I have seen her as a little child contributing poetry to Children’s World magazine published by CBT children’s book trust, winning Commonwealth Essay Contest Gold and Silver awards and as a teenager, displaying her rich oratory skills on complex topics on a number of occasions. She is a young leader with a heart, a disability advocate creating awareness about Clubfoot which is a congenital foot disorder.

What Anushka loves most (as I understand) is NUMBERS. A child math prodigy who is currently interning at the Dept. of Mathematics, Indian Institute of Science (IISc) in ‘Linear Algebra’ (beyond my comprehension 😊), she has been accepted into the prestigious 6-week Ross Mathematics Programme (just 15% acceptance rate across the globe), in the Otterbein University in Columbus, Ohio, United States focused on advanced number theory and mathematical thinking for mathematically gifted students from around the world.

- Second one to feature is Ms. Vibha Nadig, a young and

dynamic lawyer from India’s premier National Law School. Apart from scholastic excellence, as a teenager she reached the highest levels at MUN (Model United Nations), an academic simulation where students engage in debates, research, and drafting resolutions to address global issues, mimicking the work of the United Nations that fosters valuable skills like public speaking, writing, and teamwork.

dynamic lawyer from India’s premier National Law School. Apart from scholastic excellence, as a teenager she reached the highest levels at MUN (Model United Nations), an academic simulation where students engage in debates, research, and drafting resolutions to address global issues, mimicking the work of the United Nations that fosters valuable skills like public speaking, writing, and teamwork.

Vibha loves working with PEOPLE and for people. Even as a student pursuing law, she felt the need to empower the marginalised with last mile justice delivery. Founder of what is today a unique not-for-profit company (https://www.outlawedindia.com/), she conceptualised and started the initiative back in her law school days creating awareness about legal rights, training the underprivileged to become para legals and serve their underserved communities. At 25, she has been recognised as one of the Forbes Asia LLC “30 UNDER 30” Class of 2025 in the Social Impact Category !

(https://www.forbes.com/30-under-30/2025/asia/social-impact).

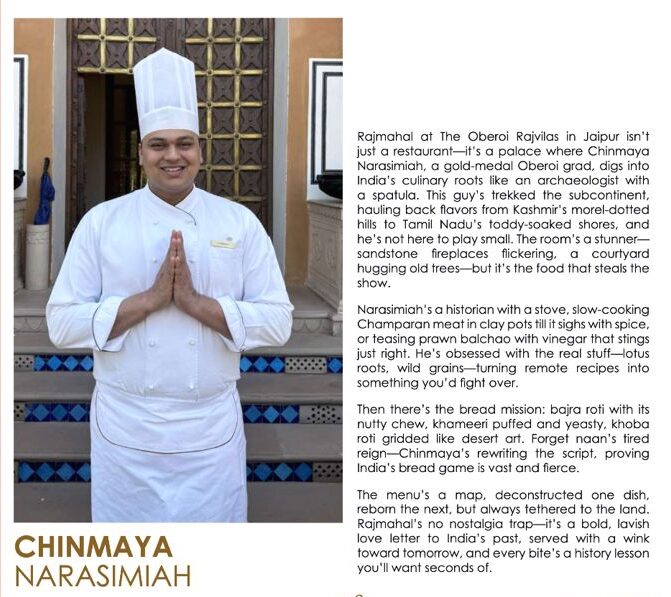

- Last (but not the least) one in my ‘picklist’ is Chef

Chinmaya Narasimiah, a young, versatile chef at the Raj Vilas Oberoi, Jaipur specialising in Indian cuisine. Even as a young boy, his first love was FOOD – dreaming of food, enjoying as a foodie, conjuring up restaurant-like menus, sketching them, serving guests in style and most importantly checking out food in all events as an unofficial ‘taster’, evaluating if it is worth a try or not ! This soon turned into a passion and ultimately into his profession that looks glamourous but can be punishing at times. From being a co-author of a Coffee Table Book on ‘Karnataka Cuisines’ published by his Hotel Management college for the Ministry of Tourism to winning a gold medal at the Oberoi Centre for Learning & Development, his recent recognition has been, being featured in the New York Food Guide (https://thegastronomesguide.com/gastronomes-guide-2025/) along with several other seasoned chefs across India ! As a parent who saw and stood by him through his initial academic struggles, it is indeed a proud moment for me.

Chinmaya Narasimiah, a young, versatile chef at the Raj Vilas Oberoi, Jaipur specialising in Indian cuisine. Even as a young boy, his first love was FOOD – dreaming of food, enjoying as a foodie, conjuring up restaurant-like menus, sketching them, serving guests in style and most importantly checking out food in all events as an unofficial ‘taster’, evaluating if it is worth a try or not ! This soon turned into a passion and ultimately into his profession that looks glamourous but can be punishing at times. From being a co-author of a Coffee Table Book on ‘Karnataka Cuisines’ published by his Hotel Management college for the Ministry of Tourism to winning a gold medal at the Oberoi Centre for Learning & Development, his recent recognition has been, being featured in the New York Food Guide (https://thegastronomesguide.com/gastronomes-guide-2025/) along with several other seasoned chefs across India ! As a parent who saw and stood by him through his initial academic struggles, it is indeed a proud moment for me.

What is the secret sauce of their achievements ? Apart from their LOVE for their calling, as someone said “Stop doing things for joy, start doing them out of joy”.

Let’s move on to the other sections of this 312th issue of Samhita. In our previous issue of Samhita, we had summarized about the clarification issued by SEBI on the position of Compliance Officer under Regulation 6 of SEBI LODR. In the ‘hero story’ section, CS Ramaswami Kalidas, a veteran in the fraternity critically analyses and shares his views on the role of CS and why the SEBI clarification is a right move in upholding the role. He has beautifully emphasised on the ‘role’ and ‘reporting’ terms. Don’t miss the insightful article !

The architect behind Samhita’s regulatory news updates, CS Rajeswari Pai has analysed RBI’s Digital Lending Directions which can be a good weekend read !

Along with this are the usual ‘culprits’ – many udpates from RBI, MCA, SEBI, ESG, GST, IT, IBBI etc. For any previous issues of Samhita and the readers’ feedback, please visit http://www.sharadasc.com/resource-center/.

Elevated status of Company Secretary as Compliance Officer under the amended SEBI (LODR) Regulations, 2015

As the fraternity is aware, SEBI has through amendments introduced to the LODR Regulations in the month of December 2024, made a slew of changes to give effect substantially to the recommendations of the Expert Committee appointed by it ostensibly to review the provisions in the above Regulations with the intent to ease considerably the economic environment relating to conduct of business by listed companies in India.

As the fraternity is aware, SEBI has through amendments introduced to the LODR Regulations in the month of December 2024, made a slew of changes to give effect substantially to the recommendations of the Expert Committee appointed by it ostensibly to review the provisions in the above Regulations with the intent to ease considerably the economic environment relating to conduct of business by listed companies in India.

One of the significant changes brought about by way of an amendment relates to the status of the Compliance Officer who is also the Company Secretary of the Company.

Regulation 6(1) of LODR contemplates that a listed company shall appoint a qualified Company Secretary as the Compliance Officer.

A proviso under Regulation 6(1) has been introduced with effect from December 12, 2024, to stipulate that the Compliance Officer shall be an officer of the company in the full-time employment of the company who stands at a level in the corporate hierarchy not more than one level below the Board of Directors who shall also be designated as a “Key Managerial Personnel”. The term “officer” for the purpose of this proviso shall carry the meaning assigned to it under Section 2(59) of the Companies Act, 2013 (hereinafter referred to as “The Act”) and Key Managerial personnel shall be one who is described as such under Section 2(51) of the Act. A Company Secretary falls within the ambit of the definition of the above term under Section 2(51).

RBI Updates

RBI vide notification dated May 08, 2025 has released RBI (Digital Lending) Directions, 2025, consolidating the earlier guidelines along with new measures for arrangements involving Lending Service Providers (LSPs) partnering with multiple Regulated Entities (REs). These Directions are applicable to all Commercial Banks, Primary Urban Co-operative Banks, State Co-operative Banks, Central Co-operative Banks, NBFCs including Housing Finance Companies and All-India Financial institutions (collectively referred as REs). These Directions are aimed at improving the borrower’s confidence in the digital lending ecosystem and address the issues of unbridled engagement of third parties, mis-selling, breach of data privacy, unfair business conduct, unethical recovery practices etc.

To read the highlights of the Directions, refer the link below.

(Open Highlights of Digital Lending Directions, 2025)

(Open RBI Notification)

A modification option has been introduced for various forms being filed through the FIRMS portal of RBI. In case of any discrepancy in the forms filed the form may be either rejected or marked for modification which shall be duly intimated to the Business User on email as well as through the dashboard on the portal.

Until now, a fresh form had to be prepared in case of any rejection during processing of such forms by AD Bank or RBI as the case may be. It may be noted that the date of resubmission of the form would be treated as the “date of reporting” for computation of LSF/Compounding as may be applicable.

In terms of the FEMA Non-Debt Instruments, Rules 2019, Investment Vehicles (INVs) registered with SEBI are permitted to issue partly paid units to persons resident outside India. Further, in terms of FEMA (Mode of Payment and Reporting of Non Debt Instrument) Regulations, 2019 an INV shall report the issuance of units to persons resident outside India within 30 days from the date of issue in Form InVi.

RBI vide circular dated May 23, 2025 has instructed that INVs shall henceforth report issuance of partly paid units as well, within 30 days of issuance. Further, any partly paid units issued prior to the circular shall be reported within 180 days from the circular i.e. by November 19, 2025 without any Late Submission Fee.

Form InVi has been updated on the FIRMS portal in line with the above.

Others

The Ministry of Home Affairs vide notification dated May 26, 2025 has amended the Foreign Contribution (Regulation) Rules, 2011. These amendments pertain to changes in various forms prescribed under the Rules right from registration to intimation of key changes in the FCRA registered entity. Some of the major changes in key forms are as follows:

Type of Form | Key changes/documents to be submitted |

Form FC-3A- Application for FCRA Registration |

|

Form FC-3B- Application for Prior Permission |

|

Form FC-3B- Application for Renewal of FCRA Registration |

|

Form FC-6A- Intimation – Change of name and/ or address within the State of the Association |

|

MCA Updates

MCA vide notification dated May 19, 2025, has amended the fourth proviso to Rule 12(1B) of the Companies (Accounts) Rules, 2014. Pursuant to the amendment, the due date for filing Form CSR-2 for the financial year 2023-24 has been extended from March 31, 2025 to June 30, 2025.

MCA vide notification dated May 07, 2025 has amended IND AS 21 under the Companies (Indian Accounting Standards) Rules, 2015. IND AS 21 prescribes norms for inclusion of foreign currency transactions and foreign operations in the financial statements of an entity. Key changes introduced through the amendment are as follows:

- Clarification on Exchangeability: The amendment explains when a currency is “exchangeable” into another as follows:

A currency is exchangeable into another currency when an entity is able to obtain the other currency within a time frame that allows for a normal administrative delay and through a market or exchange mechanism in which an exchange transaction would create enforceable rights and obligations - Spot exchange rate: An entity shall estimate the spot exchange rate in cases when a currency is not exchangeable into another currency.

Appendix A of the notification provides detailed guidance on how to assess whether a currency is exchangeable or not, how to estimate spot exchange rate when currency is not exchangeable along with the providing for disclosure requirement when a currency is not exchangeable.

SEBI Updates

ESG Rating Providers (ERPs) are required to adhere to various procedures, disclosure requirements and obligations as specified in the Master Circular for ERPs dated May 16, 2024. Pursuant to representations received, SEBI vide Circular dated April 29, 2025 has issued clarifications and guidelines which are effective immediately. The following are the key clarifications issued:

- Withdrawal of ESG Ratings

For ERPs following Subscriber Pays business model | For ERPs following an Issuer-Pays business model |

May be done as long as there are no subscribers for the rating as on date of withdrawal | Withdrawal of rating for Security may be done subject to the ERP having rated the security continuously for 3 years or 50 % of the tenure of the security, whichever is higher, and having received NOC from 75% of the bondholders by value. |

Once withdrawn, such rating shall not be made available to any subscriber in future. | Withdrawal of rating for an issuer/entity may be done subject to the ERP having rated the issuer/ entity continuously for 3 years. |

May be done for an issuer/rated entity in case of non-availability of the BRSR for such issuer/ rated entity | |

Not allowed where rated entity/instrument is part of rating package which continues to have subscribers. |

- Disclosure of Rating Rationale on the website of ERP

It is clarified that ERPs following a Subscriber-Pays business model may share the detailed Rating Rationales/ Rating Reports, as specified in the Master Circular only with their subscribers and need not to disclose on website.

However, ESG Ratings assigned on their website shall be disclosed in the format prescribed in the Circular. The circular also prescribes format for the rated entity/issuer to provide its comments on the ESG Rationale/Rating report and Standards for the ERPs to issue clarifications in response to the comments. - Disclosure of Rating Rationale on the website of Stock Exchange(SE)

The SE where a rated issuer/entity is listed shall prominently disclose the ESG rating on its website under a separate tab/section on the listed company’s page in the format prescribed in the circular. Further, the same shall also be followed for ESG Ratings of a debt security. - Internal Audit for ERPs

Considering the challenges faced by Category II ERPs in the initial years of operation, it has been clarified that the requirement to conduct internal audit shall become effective for such ERPs after a period of 2 years from this Circular.

Inclusion of Cost Accountant (ACMA/ FCMA) and Diploma in Information System Security Audit (DISSA) qualifications from the (ICMAI) in the audit team for conducting internal audit has been made to provide ERPs with larger pool. - Governance Norms of ERPs

Considering the challenges faced by Category II ERPs in the initial years of operation, the requirement for constitution of an ESG Ratings Sub-Committee and NRC shall become effective for such ERPs after a period of 2 years from this Circular.

SEBI vide circular dated May 02, 2025 has notified that instead of obtaining approval of SEBI for undertaking the securities market related activities in GIFT-IFSC, the SEBI registered Stock Brokers (SBs) may undertake these activities in any of the following manners:

- under a Separate Business Unit (SBU) of the stock broking entity; or

- if the branch of the entity qualifies as an SBU; or

- through the existing practice of undertaking these through a subsidiary.

All activities of the SBU in GIFT-IFSC would fall under the jurisdiction of the regulatory authority concerned (i.e. IFSCA), thereby making Grievance Redressal Mechanism and Investor Protection Fund (IPF) of the stock exchanges along with the SCORES Platform unavailable to investors availing the services of the SBU.

SEBI has prescribed the following key safeguards in order to demarcate the regulatory obligations and to ring fence the activities of the SBs in Securities Market and that of SBU in GIFT-IFSC:

- SBs shall ensure that their activities in the Indian securities market and the securities market related activities of the SBU in GIFT-IFSC are segregated and independently managed with separate accounts. SBs shall ensure arms-length relationship between these activities is maintained.

- SBU in GIFT-IFSC shall be exclusively engaged in providing securities market related activities as permitted by the IFSCA and carrying them out in a manner as prescribed by IFSCA.

- The net worth of the SBU shall be kept segregated from the net worth of the SB in the Indian securities market. Net worth of the SB shall be considered after excluding account of the SBU. The net worth for the purpose of the SBU shall be as per regulatory framework issued by the regulatory authority concerned.

SBs who have already floated subsidiary or entered into joint venture to undertake securities market related activities in GIFT-IFSC after obtaining approval from SEBI, shall have an option to discontinue at its discretion, such subsidiary/joint venture and carry out such services under an SBU of the stock broking entity itself.

In terms of Regulation 4(g)(i) of SEBI (Alternative Investment Funds) Regulations, 2012 read with SEBI notification dated May 10, 2024 on SEBI (Certification of Associated Persons in the Securities Markets) Regulations, 2007 at least one key personnel of the key investment team of the Manager of an Alternative Investment Fund (AIF) shall hold certificate under ‘NISM Series-XIX-C: Alternative Investment Fund Managers Certification Examination’.

SEBI vide circular dated May 13, 2025 has extended the timeline for complying with the above requirement from May 09, 2025 to July 31, 2025.

IFSCA Updates

IFSCA vide circular dated May 21, 2025 has prescribed norms for enabling participation of IFSC Banking Units (IBUs) in International Payment Systems (IPS).

- IBUs may participate in IPS for making or receiving payments to/from banks/financial institutions outside IFSC without prior approval of the IFSCA.

- However, if such payment system enables the IBUs to make or receive payment among themselves, resulting in domestic transactions, prior approval of IFSCA would be required.

- IPS may also be used for making or receiving payments with other IBUs subject to above.

- IBUs have been directed to intimate the Department of Banking Supervision about its compliance with the above within 30 days.

In terms of Regulation 132 of the IFSCA (Fund Management) Regulations, 2025, a Fund Management Entity (FME) is required to appoint an independent custodian, based in IFSC to provide custodial services for the following schemes:

- Retail schemes;

- Open ended Restricted schemes; and

- All other schemes managing AUM above USD 70 Million.

IFSCA vide circular dated May 24, 2025 has provided additional 6 months’ time for appointment of such custodian for the schemes taken on record by the IFSCA after the Regulations came into effect on February 19, 2025 or those taken on record by the IFSCA prior to the Regulations coming into effect but which did not enter into an agreement with a custodian as on February 19, 2025.

During the 6 months’ time, the FME may appoint an independent Custodian in India or any foreign jurisdiction regulated by the financial sector regulator in that jurisdiction. Further, such information shall be provided to the IFSCA as and when directed to do so.

IBBI Updates

IBBI vide notification dated May 19, 2025 has amended the IBBI (Insolvency Resolution Process for Personal Guarantors to Corporate Debtors) to insert Regulation 17B- Non-submission of repayment plan. It states that if a debtor fails to submit a repayment plan under section 105 of the Code, the resolution professional shall file an application with the Adjudicating Authority for intimating the non-submission of repayment plan and seeking appropriate directions. This shall be done with approval of the creditors.

The amendment effective immediately, is aimed at increasing the accountability of corporate debtors and ensure transparency along with strengthening creditor confidence.

Regulation 40B of the IBBI (Insolvency Resolution Process for Corporate Persons) Regulations, 2016 prescribes various forms to be filed by the insolvency professional, interim resolution professional or resolution professional, as the case may be. IBBI vide notification dated May 19, 2025 has substituted the said Regulation 40B with revised forms, timelines and penal provisions for failure to file on time.

ESG Updates

Ministry of New and Renewable Energy (MNRE) launched the Green Hydrogen Certification Scheme of India (GHCI) on April 29, 2025 as part of the National Green Hydrogen Mission. The framework of the Scheme provides for certification of green hydrogen production. The certification will not only boost credibility in the market but also the exports of the same. Relevant rules have also been notified for claiming offset under the Carbon Credit Trading Scheme (CCTS).

(Open PIB release dt April 29, 2025)

(Open ESG News dt May 01, 2025)

Recently Microsoft announced launch of new solutions for users of its Azure cloud computing platform, aimed at reducing carbon emissions caused from the cloud’s usage. Sustainability features such as carbon emission analysis, carbon optimization, integration of sustainability factors into daily cloud operations are being introduced.

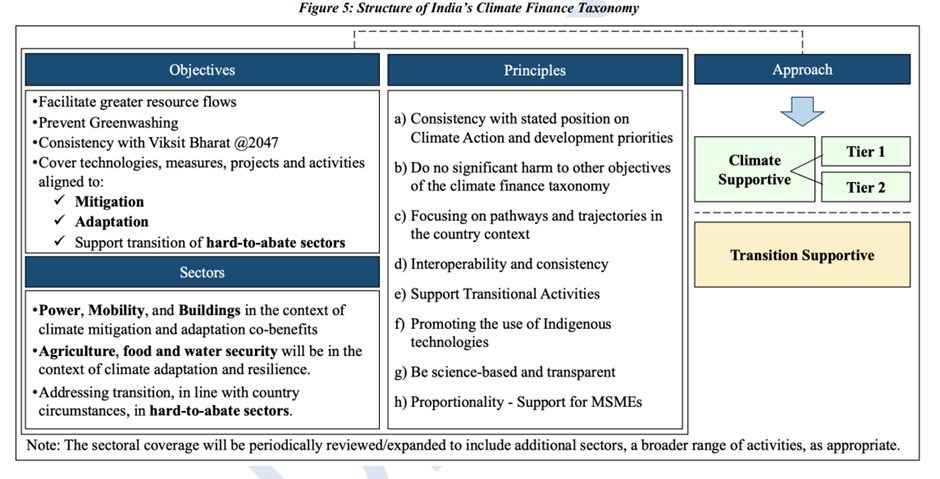

Draft Framework of India’s Climate Finance Taxonomy

In furtherance to Union Budget announcement to develop India’s Climate Finance Taxonomy Department of Economic Affairs, Ministry of Finance has released draft framework for the same. The taxonomy is aimed to facilitate greater resource flow to climate-friendly technologies and activities, enabling India to achieve the vision of being Net Zero by 2070. The Taxonomy covers technology, measures and projects aimed at the following key aspects:

- Mitigation of GHG emissions including through the expansion of non-fossil fuel energy, etc

- Adaptation of resilience action including resilient infrastructure, climate resilient seeds, sustainable water management etc to lower the negative impact of climate change

- Support transition in hard to abate sectors – innovation and R&D that lower carbon pathways by taking into account available technology, its access and viability.

Qualitative aspects aligned with SDGs and quantitative aspects such as GHG savings, improvements in emission intensity etc have been considered for the framework.

The taxonomy aims to prevent Greenwashing and stay aligned with the developmental goal of Viksit Bharat.

Public comments have been invited and the same may be submitted by June 25, 2025

Tax Update

CBDT has announced an extension of the deadline for filing Income Tax Returns (ITRs) for the Assessment Year (AY) 2025-26 from July 31, 2025 to September 15, 2025. The extension has been announced to accommodate filings amidst significant structural and content modifications to the ITR forms notified for AY 2025-26. These changes are designed to simplify the filing process, enhance data accuracy, and align with evolving tax regulations. However, the updates necessitate additional time for the development, integration, and testing of the associated e-filing systems and utilities to ensure seamless functionality for taxpayers and tax professionals.

Additionally, the visibility of Tax Deducted at Source (TDS) credits, based on statements due by May 31, 2025, is expected to be available only in early June 2025. This delay reduces the effective window for taxpayers to verify and incorporate accurate TDS data into their returns, further justifying the need for an extended timeline.

GST Updates

The GST Network (GSTN) has updated the refund filing process for:

- Export of Services with Payment of Tax

- Supplies to SEZ Unit/SEZ Developer with Payment of Tax

- Deemed Export Refunds by Supplier

Key Updates:

- No Tax Period Selection: Taxpayers can directly select the refund category and create applications without specifying a tax period.

- Invoice-Based Filing: Refunds can be claimed by uploading invoices in:

a) Statement 2(Export of Services)

b) Statement 4 (SEZ Supplies)

c) Statement 5B (Deemed Exports) - Invoices are locked post-upload, unlocked only if the application is withdrawn or a deficiency memo is issued.

- Mandatory Returns: All due returns (e.g., GSTR-1, GSTR-3B) must be filed before applying.

GST has published an advisory on Appeal Withdrawal Process:

Filed before Final Acknowledgment (APL 02): Filing a withdrawal application (APL 01W) automatically withdraws the appeal (APL 01), changing its status from “Appeal Submitted” to “Appeal Withdrawn.”

Filed after Final Acknowledgment: Withdrawal requires Appellate Authority approval. Upon approval, the appeal status changes to “Appeal Withdrawn.”

Section 128A Waiver Scheme requires that appeals against a demand order must not remain pending to qualify for the waiver.

In both cases above, achieving “Appeal Withdrawn” status meets this requirement. Taxpayers must upload a screenshot of the appeal case folder showing “Appeal Withdrawn” status when filing or updating a waiver application.

As per GSTN’s advisory dated April 11, 2025, the auto-populated values in Table 3.2 of Form GSTR-3 B were to become non-editable from the April 2025 tax period (returns due in May 2025).

In the interest of taxpayer convenience and to facilitate smooth filing, GSTN vide Advisory dated May 16, 2025 has notified that Table 3.2 shall remain editable. Taxpayers should verify and amend auto-populated entries for accurate returns.

Further, changes will be communicated separately once implemented on the GST portal.

June 2025

Quote of the day

The 3 "C"in life: Choice, Chance,and Change. You must make the choice, to take the chance, if you want anything in life to change. - Baba

Disclaimer: The contents of this Newsletter are only a summary and has not dealt with any issue in detail. Any action taken or proposed to be taken must be in consultation with professionals and not merely based on the articles / news updates. S. C. Sharada & Associates disclaims all liability on action taken without professional advice.